Employers are always searching for new ways to differentiate themselves from the competition and attract top talent. One of the most unique and successful ways that they’ve been able to do that is through the use of company-provided vehicles. However, it is not as simple as just handing over the keys. In order to successfully implement a program, certain processes and procedures must first be in place. One of the most overlooked aspects of a company-vehicle program is that of Personal Use.

When driving a company-provided vehicle, all of the miles that are driven can be classified in one of two ways: Business Miles or Personal Miles. What’s the difference between the two? Simply put, business miles are any miles driven between two business locations (with the exception of commuting to/from your office). Personal miles are any miles driven outside of the course of doing business. For example, driving from your office to a client meeting would be considered business mileage. Conversely, driving home from that meeting, or driving to a doctor’s appointment during your lunch break would be considered personal mileage.

Why is it necessary to differentiate between the two types of mileages? Because, per the IRS, a company-provided vehicle is considered to be a fringe-benefit, and thus there is a small cost to the employee. We’ll be discussing the methods of calculation in a subsequent article, however, according to the September 2018 issue of Automotive Fleet Magazine, the average personal use charge to employees comes in at approximately $134 per month. That is the amount that the employee must pay to cover the personal use portion of their company-provided vehicle, and will be reflected on their W-2 form.

While that number is just an average, and will vary by driver, the amount charged is generally significantly less than a car payment. Additionally, personal use charges allow the company to recoup some of the cost of the program.

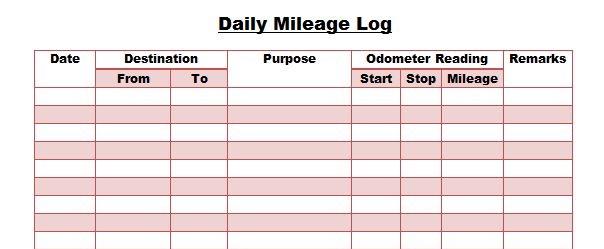

Because the amount of money that an employee may owe is based upon the amount of personal miles that are driven, it’s absolutely vital that accurate mileage logs are kept. Should an employee fail to keep records of their mileage, the IRS may deem that 100% of the miles driven were for personal use. There are various methods of tracking mileage, either electronically, or by hand, but whatever method is chosen should capture a few key pieces of data. Things such as the date, beginning location, ending location, starting odometer, ending odometer, total mileage, nature of the trip, and any ancillary costs (such as tolls) should all be noted. There are a plethora of templates available online, but here is an example of one such worksheet courtesy of Template Lab.

In order to eliminate any potential confusion, employers need to be sure to have a clearly defined policy when it comes to personal use. Outlined within should be rules and regulations regarding acceptable use of the vehicle, as well as procedures for accurate reporting of mileages. Doing so will eliminate potentially costly mistakes and make both employee’s and employer’s lives easier.

Be sure to check back next week as we will be discussing the various methods used in the calculation of personal use charges, as well as a walkthrough of some example calculations.