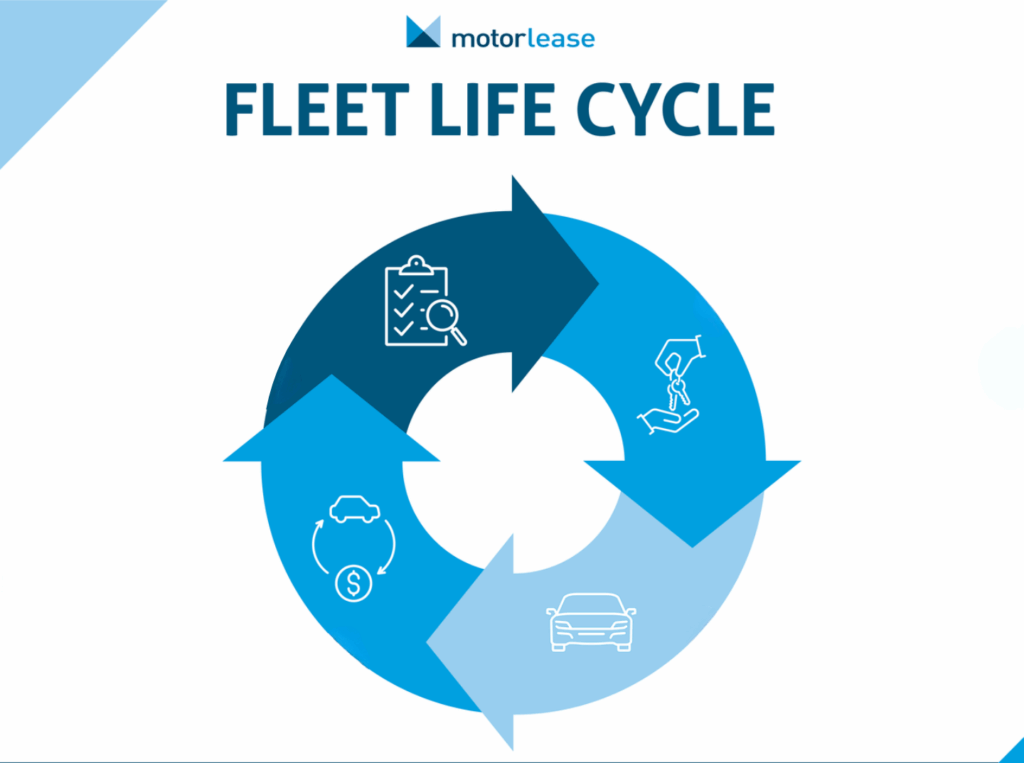

In Part 1 of this series, we discussed several key components of a comprehensive fleet policy such as: Driver eligibility, vehicle selection, personal use, and distracted/impaired driving. In this week’s article, we’ll take a look at some additional elements that should be considered.

In This Article

Maintenance

Fuel

Accidents & Repairs

Vehicle Replacement

Acknowledgement

Compliance & Enforcement

Maintenance

Whether your company handles its own maintenance, or is enrolled in a maintenance program through a fleet management company, maintenance requirements and procedures should be spelled out in your company’s fleet policy. If your employees are responsible for certain tasks, such as taking the vehicle in for an oil change, maintaining proper tire PSI, having tires rotated, etc. then that needs to be written out for them. If there are certain procedures for getting maintenance work approved, then that should be spelled out also.

Fuel

Most companies who provide vehicles use one of two methods when it comes to fuel: Employees are either reimbursed for their full expenses, or they are given a company fuel card to use. Regardless of which method your company uses, be sure to document that process clearly. If employees are required to submit receipts or log mileage, spell that procedure out to avoid any potential misunderstandings. This is especially important for employees who receive company-provided gas for personal use as the IRS considers that to be a fringe benefit. In that scenario, a calculation will need to be made in order to determine the value of the fuel used for personal use. Employees will then be required to pay taxes on that amount.

Accidents & Repairs

As much as we try to avoid them, accidents happen. So when they do, it’s important for your employees to know exactly what is expected of them. They need to know who they should call (police, fleet manager, insurance company, fleet management company), and how quickly after the accident they need to contact them. Make sure to list all relevant phone numbers and advise on any documentation that needs to be submitted. If there is a procedure for having the vehicle repaired, such as obtaining multiple estimates, or obtaining a rental vehicle, be sure that the employee is aware of that as well.

Vehicle Replacement

To eliminate confusion, jealously and even possibly an HR issue among colleagues, the company’s replacement criteria should be spelled out in clear terms. The most common criteria for replacement are either a mileage or months in service threshold, but that determination will be made by your company in conjunction with your fleet management company (if applicable). Regardless of what criteria you choose for replacement, it needs to be communicated clearly within the policy.

Acknowledgement

To protect itself, the company needs to be sure to distribute the policy to any and all necessary persons. It is also imperative to have those people then sign an acknowledgement of receipt form. Once that form is received, it should be stored, either physically, electronically, or both, for future reference. If an employee gets into an accident that results in a lawsuit against the company, you’re going to need to be able to produce that acknowledgement form to prove to the court that the employee was made aware of your company’s policies.

Compliance & Enforcement

There is no point in doing all of the work needed to develop a comprehensive fleet policy if it’s not going to be enforced. One of the final things that should be outlined in your fleet policy is who is responsible for enforcing the policy, and what the remedies will be for non-compliance. It’s critical not to overlook the importance of enforcement, as doing so leaves your company vulnerable to potential lawsuits. For example, in 2012, a Domino’s Pizza delivery driver was involved in an accident that resulted in a fatality. It was later determined that the accident was caused, in part, by worn brakes on the delivery driver’s vehicle. The Domino’s Pizza fleet policy required regular safety inspections of delivery vehicles, but the policy was rarely enforced. The result was a $32 Million judgement against the company. Protect your drivers and your company by staunchly enforcing policy compliance.

A comprehensive fleet policy is the cornerstone of any successful fleet program. It spells out standards of conduct, and eliminates confusion. Putting a policy together can be a lot of work, but it’s an absolutely critical undertaking.

If you would like a no obligation fleet policy review, be sure to contact us at (860) 677-9711 or info@motorlease.com.