In This Article

Do You Have the Right Partner to Help Control Costs?

Developing an Optimized Vehicle Replacement Schedule

Fighting Inflation by Budgeting for Years in Advance

Lowering Your Capital Outlay

Reducing Employment Costs

Do You Have the Right Partner to Help Control Costs?

You’ve likely noticed the prices of everyday goods have risen exponentially over the past couple of years. While gas and grocery prices are top of mind for most consumers, many fleets have discovered that the vehicle market is not immune to rising costs. This has resulted in the cost of vehicle ownership reaching an all-time high. So, how can we control costs in a turbulent economy?

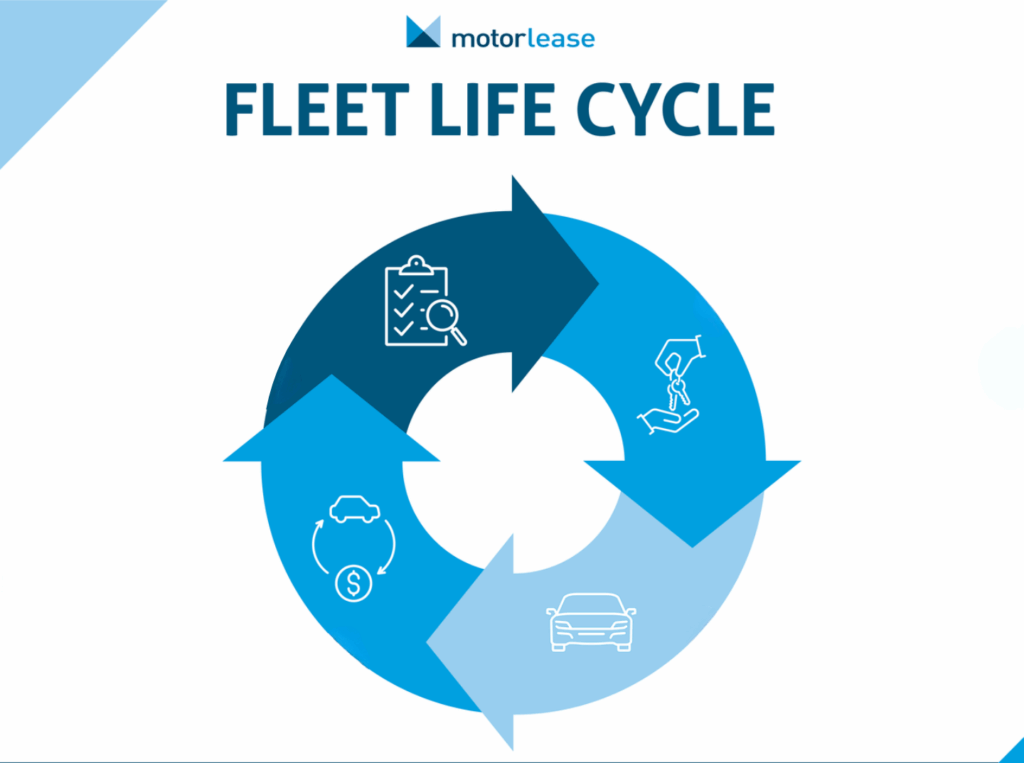

For many organizations, the answer lies in having the right fleet management partner. We will review the techniques a savvy fleet management company can use to help ease the rising costs associated with operating a fleet.

Developing an Optimized Vehicle Replacement Schedule

When we ask potential fleet partners to describe their vehicle replacement strategy, we hear various answers ranging from “every 4 years or 100,000 miles” to “until the wheels fall off.” However, when we ask for the logic behind their methods, we’re often met with silence or some variation of “we’ve always done it this way.”

Regardless, it is essential to operate with a strategy when looking to control costs and manage your fleet in the most efficient manner possible. A good fleet management partner will assist in developing a vehicle replacement schedule that is backed by data and based on the unique usage pattern of your vehicles.

When assessing vehicle replacement, Motorlease will consider more than the age and mileage of the vehicle to make a recommendation. Our team will determine the maintenance costs needed to maintain the vehicle and make suggestions based on the replacement schedule so that you are not paying for unnecessary repairs. Additionally, Motorlease will assess the used-vehicle market conditions and replacement options to find the optimal time to flip the vehicle for a new one. A solid vehicle replacement schedule will make managing a fleet more predictable and have significant long-term cost-saving effects.

Fighting Inflation by Budgeting for Years in Advance

In uncertain economic times, would you rather have more or less financial certainty? A good fleet management partner can take the guesswork out of managing an annual fleet budget, not just for the current year but for multiple years at a time. As costs continue to rise and follow unpredictable trends, organizations with fleets are looking for ways to control costs.

Many fleet management companies tout the benefits of finance leasing. However, they do not reveal the enormous risks you can allow into your organization. Our clients look to us to provide stability in uncertain economic times by providing their teams with all-inclusive solutions and fixed monthly payments. And that is precisely what Motorlease provides through our closed-end leasing program. We give our clients the peace of mind that comes with knowing exactly what their fleet spend will be for years in advance.

Lowering Your Capital Outlay

As the saying goes, “cash is king,” and with climbing expenses, that phrase has never been more true.

A fleet management partner that has your best interests in mind will develop solutions that allow you to retain as much capital as possible while still meeting everyday fleet operation needs. The most significant capital outlay for fleets comes by way of vehicle acquisition. With vehicle costs setting records year after year, purchasing has become a massive expense for many fleets. As a result, businesses have turned to fleet management companies to provide leasing programs for their drivers. Since vehicle leasing requires little, if any, initial capital, companies can retain significant funds, which can be used in other areas of the business.

Reducing Employment Costs

When assessing a business’s largest expenses, payroll is likely to be near, if not at the top. For each employee hired, the company will pay a salary, benefits, taxes, etc. For those considering bringing on a full-time fleet manager, a more cost-efficient solution may be to partner with a fleet management company that can act as a de-facto fleet manager. However, not all fleet management companies are interested in this approach. Many larger fleet management firms exclusively work with sizable organizations that employ entire fleet departments. While other organizations, such as Motorlease, specialize in working with fleets that don’t have in-house fleet managers. Fleet management companies, like Motorlease, can lower payroll costs by taking on the role of a fleet manager, as we’ve done for our clients for over 75 years.

For the latest on vehicle trends and industry news, follow us on LinkedIn.