In This Article

Types of Leases

Closed-End Lease

Equity Lease

Advantages of Leasing for Companies

Types of Leases

There are a couple of different types of vehicle leasing arrangements. A closed-end lease is what is most commonly advertised and offered to the general public, while an equity lease is typically a product reserved for commercial consumers.

Closed-End Lease

When most people talk about leasing, they’re generally referring to a closed-end lease. A closed-end lease is a type of rental agreement where the leasing company (lessor) is responsible for the loss or gain in resale at the end of the agreement.

Typically, a closed-end lease has a fixed term (usually measured in months) and a mileage allowance. At the end of the contract, while generally given the option, the lessee is under no obligation to purchase the vehicle. They can simply return the vehicle and “walk away.”

Example: A 36-month lease with a 60,000-mileage allowance.

Equity Lease

An equity lease, also commonly referred to as an “open-end lease,” “TRAC lease,” “finance lease,” or “capital lease,” refers to a type of lease where the cost of the vehicle is depreciated a set amount each month until you reach a predetermined balance (or zero balance). The lessor can generally terminate the lease at any point, however, the equity of the vehicle, either positive or negative, is their responsibility.

Example: You’re in an equity lease and depreciating the vehicle at 2% per month. After 36 months, you decide that you want to get out of the lease. The remaining book value of the vehicle is $10,000, however, due to market conditions, it can only be sold for $7,000. If you elect to get out of the lease, you’re going to be responsible for that $3,000 deficit.

Conversely, assume the same scenario, except the used vehicle market is in an uptrend and the vehicle can be sold for $12,000. That additional $2,000 is yours to keep.

Advantages of Leasing for Companies

When compared to purchasing, leasing offers several key advantages such as:

- Allowing you to pay only for the portion of the vehicle that you use.

- Requiring less money upfront and offering lower monthly payments, thus resulting in greater cash flow flexibility.

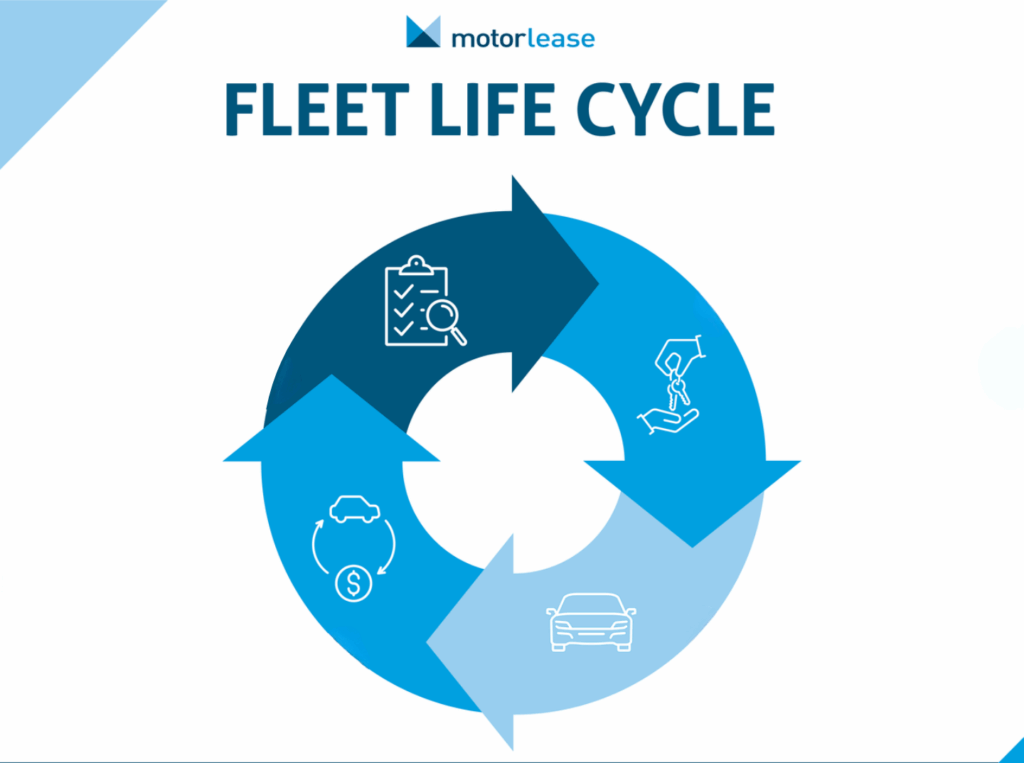

- Improving your company’s image by implementing a defined life cycle that puts your drivers in newer vehicles more often.

- Lowering the total cost of ownership by avoiding the later years of a vehicle’s life when maintenance costs rise exponentially.

- Vehicle disposal is generally handled by the lessor.