Explore Our Glossary of Terms

A

Allocation

The process of assigning a vehicle to a specific driver, department, or purpose based on business needs and usage requirements.

Amortization Schedule

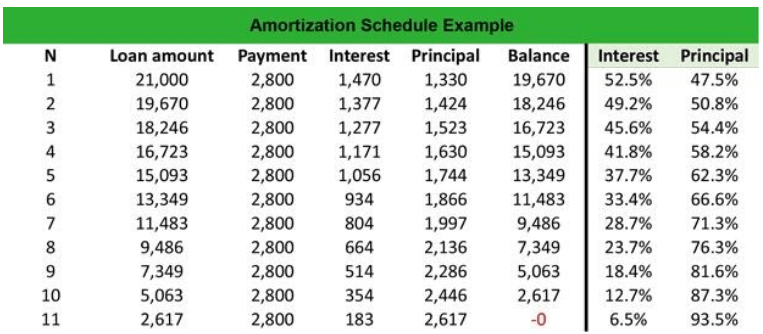

Amortization refers to spreading out a loan into a series of payments.

These payments consist of two portions: principal and interest. While the amount of each payment generally stays the same, the portion of your payment that goes toward each respective portion changes over time.

Example) A mortgage is amortized over a set period. At the beginning of your term, the vast majority of your payment goes toward interest on the loan. As the loan matures, the portion allocated for interest decreases while a greater portion of your payment goes towards paying down the principal. The last payment of the loan will pay off the entire debt.

An amortization schedule sometimes referred to as an “amortization table,” illustrates exactly how your loan works and can help you see precisely what your outstanding balance or interest cost is at any point during the term.

What Information Will I See in an Amortization Schedule?

Amortization schedules show several pieces of information such as:

Scheduled Payments – The table will list all your required payments by the due date for the length of the loan.

Interest Expenses – A portion of each payment is allocated towards interest. Your amortization schedule will show you exactly how much each payment is going towards finance charges.

Principal Repayment – After the interest portion is accounted for, the remainder of your payment will be applied toward the principal. Like interest expenses, the amortization schedule will illustrate precisely how much each payment is allocated toward paying down the original loan amount.

Example) Below is a sample amortization schedule

Why is an Amortization Schedule Useful?

After the interest portion is accounted for, the remainder of your payment will be applied toward the principal. Like interest expenses, the amortization schedule will illustrate precisely how much each payment is allocated toward paying down the original loan amount.

Example) A company is considering terminating its equity lease after 24 months. An amortization schedule allows them to compare their remaining principle against the potential book value. Having this information will enable them to determine whether terminating the lease at that point in time is a wise decision.

How can we help?

C

Capitalized Cost

When discussing vehicle leasing, the capitalized Cost, sometimes referred to as “cap cost,” refers to the amount being financed. This amount includes the Cost of the vehicle less any applicable incentives, plus additional fees or charges. Typically, the lower the capitalized Cost, the lower the lease payment.

Cap Cost Reduction

Occasionally, you may hear the term “cap cost reduction.” A cap cost reduction is an optional upfront payment to reduce the overall cap cost. Much in the same way you make a down payment when purchasing a vehicle, you can elect to make a cap cost reduction payment to lower your monthly lease rate.

Can a more expensive vehicle have a lower lease rate?

The answer to this question varies depending on the type of lease that you are talking about. With an equity lease, the lease rate is heavily influenced by the capitalized Cost. Assuming applicable incentives, interest rate, monthly depreciation percentage, and management fees are all equal, there is no scenario where a $35,000 vehicle would be leased out for a lower monthly rate than a $30,000 vehicle.

However, this isn’t necessarily the case when referring to a closed-end lease. Because a closed-end lease rate is largely determined by the residual value of a vehicle, it is possible for a more expensive vehicle to have a lower monthly lease rate than a cheaper vehicle.

Example) A $30,000 vehicle with a residual value at the lease end of $10,000 leaves a $20,000 balance to finance. A $35,000 vehicle with a $17,000 residual value at the lease end would leave a $18,000 balance to finance, thus resulting in a lower lease rate than the $30,000 vehicle.

Closed-End Lease

A closed-end lease is a type of rental agreement where the leasing company (Lessor) is responsible for the loss or gain in resale at the end of the agreement. Typically, a closed-end lease has a fixed term (usually measured in months) and mileage allowance. At the end of the contract, while generally given the option, the lessee is under no obligation to purchase the remainder of the vehicle. They can simply return the vehicle and “walk away.”

Example) A 36-month lease with a 60,000-mileage allowance

Unlike an “equity lease”, where the lease rate is primarily determined by capitalized cost, a closed-end lease rate is highly sensitive to specifics such as make, model, trim, lease term, and mileage. That is because the lease rate of a closed-end lease is primarily determined by the vehicle’s residual value (anticipated value at lease end). The residual value is determined at the beginning of the lease by the leasing company; however, unlike an Equity (or open-end) lease – you are not responsible for that value at the end. Removing risk is a key differentiator in Closed-End Leases. In Equity Leases, you are responsible for the loss or gain in the value of the vehicle. Closed-End leases remove you from that risk. Additionally, closed-end leases may allow you (the lessee) to get a nicer, more highly equipped vehicle for a lower cost based upon a higher residual value than a less expensive, lower equipped vehicle.

Example) Car A, a $30,000 vehicle with a $18,000 residual value, may lease for a lower amount than Car B, a $27,000 vehicle with a $12,000 residual value, despite Car B costing $3,000 less than Car A.

In addition to being insulated from the risks of the used car market, a Closed-End lease allows you to budget your transportation expense at the beginning of the agreement rather than waiting until the vehicle is sold to discover your actual costs. Granted, there is an excess mileage charge with a closed-end lease. However, it is important to keep in mind that you will pay for the portion of the vehicle that you use regardless of whether you are in an Equity Lease, purchase the vehicle outright, or in a Closed-End lease.

Another advantage of closed-end leasing is establishing a set life cycle for your vehicles. Knowing exactly when you’re going to replace your vehicles will allow you to properly manage logistics, forecast necessary repair work, and keep drivers in new, late model vehicles with the latest advanced safety features.

Collision and Comprehensive Insurance

Comprehensive and collision insurance are two parts of an automobile insurance policy designed to cover the replacement value of the insured’s vehicle. When people refer to having “full coverage” on a vehicle, they often mean that the vehicle has comprehensive and collision insurance coverage. Unlike liability insurance, which is required by law in every state except New Hampshire, comprehensive and collision insurance are not mandated by the states. However, if the vehicle is financed or leased, the lender will typically require the insured to carry comprehensive and collision coverage as part of the contract. Typically, both coverages come with a deductible (some states mandate a zero deductible for glass coverage for retail customers) that, in the event of a claim, must be paid prior to your insurer settling your claim.

Collision Insurance

As the name implies, collision insurance is a coverage designed to pay to repair or replace your vehicle in the event of a collision with another vehicle or object, such as a lamp post.

For example, while driving, you hit a patch of black ice and collide with a tree. Your insurance company would pay to repair or replace your vehicle (minus your deductible) under the collision portion of your policy.

While collision coverage primarily applies when you are at fault for the incident, there are circumstances when it would apply even if you are not at fault.

Example) You’re rear-ended by an uninsured driver and don’t have uninsured/underinsured motorist property damage coverage. In this scenario, you would make a claim against your collision coverage to cover the damage to your vehicle (Note: Your collision coverage would NOT pay out for any bodily injury sustained)

Example) Assume the same scenario as above, except instead of being uninsured, the driver who hit you has $25,000 worth of property damage coverage. However, the amount of damage to your vehicle comes to $35,000. In this scenario, you would first be paid by the other driver’s insurance carrier up to their property damage policy limit. You would then file a claim under your collision coverage for the remainder.

Comprehensive Insurance

Unlike collision insurance, comprehensive insurance covers damage to your vehicle caused by anything other than a collision, such as fire, hail, vandalism, animal, break-in, and more. Like collision coverage, comprehensive coverage also has a deductible that must be satisfied before the insurer will pay out.

Example) While driving home, a deer runs out in front of your vehicle, and you collide with it. The damages to your vehicle would be paid out (minus your deductible) by the comprehensive portion of your policy.

There doesn’t necessarily have to be damage for the comprehensive portion of your policy to kick in. Comprehensive coverage would also pay to replace your vehicle in the event that it is stolen.

D

Dealer Installed Options (DIO)

Features or accessories added to a vehicle by the dealership after manufacture but before delivery, such as navigation systems, upgraded wheels, or custom interiors.

E

Equity Lease

An equity lease, also commonly referred to as an “open-end lease,” “TRAC lease,” “finance lease,” or “capital lease,” refers to a type of lease where the Cost of the vehicle is depreciated a set amount each month until you reach a predetermined balance (or zero balance at all).

Pros of Equity Leases

Many companies utilize equity leases because of the flexibility that it provides them. Equity leases generally have no mileage restrictions, thus eliminating any potential end-of-lease excess mileage fees.

Equity leases also allow the user to get out of the lease at nearly any point of their choosing (generally, there’s a minimum term of 12 months to be considered a lease by accounting standards). Unlike closed-end leases, there is no fixed term with an equity lease.

Companies who tend to be a bit rougher on their vehicles also prefer equity leasing because there is generally no lease-end damage on the return bill (more on that later).

Cons of Equity Leases

While there are many great qualities that make equity leases quite attractive, there are also some significant drawbacks.

For many, the biggest downside of equity leases are the entire brunt of the financial risk upon resale lies with the user. With a closed-end lease, the lessor is assuming that risk. This is not the case with an equity lease, which can be a positive or a negative, depending on market conditions and your remarketing expertise.

Example) You have an equity lease and depreciating the vehicle by 2% per month. After 36 months, you decide to get out of the lease. The remaining book value of the vehicle is $10,000; however, due to market conditions, the vehicle can only be sold for $7,000. If you elect to get out of the lease, you will be responsible for that $3,000 deficit.

Conversely, assume the same scenario, except the used vehicle market is in an uptrend, and the vehicle can be sold for $12,000. That additional $2,000 is yours to keep.

Another point, excess mileage and damage-on-return fees -While there are no set restrictions on either since the financial responsibility is ultimately yours, you will pay for it through a diminished resale value.

An equity lease is a fantastic tool for the right situation, but careful analysis should be done prior to determining which lease type is right for your company.

Excess Mileage

The term is associated with a Motorlease Straight Term Lease, where the vehicle has been driven for more miles than the contract allows. A small fee is assessed for each mile driven over the prorated mileage allowance.

F

FMC

Fleet Management Company – a company that manages vehicles and provides services for companies where vehicles are necessary to do their business.

L

Lease Rate

Put simply, the lease rate, sometimes referred to as a “rental rate” or “monthly rental rate,” is your monthly obligation to use the vehicle. However, what most people don’t know, are the numerous components that ultimately go into calculating that figure.

Calculating a Closed-End Lease Rate:

There are 3 factors that make up the lease payment on a closed-end lease:

Depreciation

Finance Fee

Taxes

To calculate the lease rate on a closed-end lease, you first need to determine how much the vehicle is anticipated to depreciate over the course of your lease term.

Example) Consider the lease of a $30,000 vehicle on a 36-month/60,000-mile term. The lessor will utilize all the data at their disposal to forecast what that vehicle will be worth at the end of that term. This is called the “residual value”. In our example, we’ll assume this to be $14,000. Therefore, the depreciation of the vehicle over the lease term would be $16,000 ($30,000 starting price – $14,000 residual value). If you take the total depreciation and divide it by the number of months into the terms, you’ll get your monthly depreciation amount ($16,000/36 months = $444.44/month). Far the largest portion of your payment.

The second component to your lease rate is the finance fee. This figure may be expressed as an interest rate or a “money factor”, depending on the lessor, but it is essentially calculating the Cost of borrowing. This number may fluctuate depending on factors such as the current prime rate, the borrower’s credit, and more.

The final factor that completes the closed-end lease rate is the applicable taxes. This component will vary from state to state. Some states apply sales tax to each monthly payment, while others may require the entire amount due upfront. Check with your state to determine exactly how that is handled in your area.

Calculating an Equity Lease Rate:

An equity lease is an entirely different product than a closed-end lease, and thus the rate is calculated differently. An equity lease rate is calculated in a very similar way to a purchased vehicle.

As opposed to a closed-end lease, an equity lease does not have a fixed term or mileage limit. Instead, the vehicle is depreciated by a set amount each month (called a ‘depreciation reserve’) until a specified point in time.

Example) Assume a $40,000 vehicle depreciated at 2% per month. Depreciating at this percentage will take the vehicle down to a depreciated book value of $0 after 50 months (100% of book value/2% per month = 50 months). In this scenario, your monthly depreciation reserve would equal $800/month ($40,000 x 2%).

However, like most finance arrangements, there is an interest component as well. This will need to be factored in and added to your depreciation reserve. Your fleet management company should provide you with an amortization schedule so that you can see exactly how much of your payment is being applied to the principal and how much is being applied to interest each month.

Lease Term

Put simply, a vehicle lease term is the period of time which the vehicle will be leased. This term is agreed upon up front and may vary for different drivers within your fleet. Depending on the type of lease, you may encounter a straight lease term, a variable lease term, or an open-ended lease term.

Straight Term Lease

Under this type of arrangement, the lease term is fixed upfront. The lessee is contractually obligated to lease the vehicle from the lessor for the agreed upon amount of time. If the lessee wishes to terminate the lease early, they may be subject to early termination fees, which can vary greatly between fleet management companies. The advantage of this type of lease term is the ability to set a defined life cycle for your vehicles.

(Leasing companies specializing in Closed-End leases will typically allow you to renegotiate your lease term, even in the middle of the contract, without a change fee. However, your lease rate is likely to change.)

Example) A lease written as 36 months/45,000 miles has a term of 36 months.

Variable Term Lease

Like the straight term closed-end lease, a variable term closed-end lease caps the period of time for which the vehicle is leased for. However, unlike the straight term closed end lease, the variable term lease also contains a provision that allows the lease to terminate upon hitting a specified mileage threshold determined before inception. Because of the mileage trigger, each driver’s lease term may vary.

Example) A variable term closed end lease may be written as expiring in 48 months OR 80,000 miles, whichever occurs first.

*Pro Tip* – A Closed-End lease with a Variable Term (where vehicles are cycled based upon mileage rather than a specified term) should NEVER have an excess mileage charge.

Lessee

Businesses that have an existing right to use a Motorlease vehicle for a contracted period of time.

Lessor

Owner of a vehicle (Motorlease) who grants the lessee’s permission to use the vehicle under specific terms & conditions for a fee.

Liability Insurance

Liability insurance is a form of automobile insurance coverage designed to protect the insured if they are deemed at fault for an accident.

There are generally two components that make up your liability coverage, each with separate coverage limits:

Bodily injury liability coverage: This coverage is designed to apply toward the other party’s medical expenses in an accident in which you’re deemed to be at fault. In some scenarios, this portion may also cover items such as lost wages and legal fees.

Property Damage: This coverage applies to any property damage you may have caused in the accident. It primarily covers vehicle repair or replacement costs but can also apply to other damaged items such as lamp posts, phone poles, fences, structures, and other policy items.

Example) You’re driving home from work and happen to lose focus for a brief minute. When the vehicle in front of you stops, you don’t and strike their vehicle from behind. In this scenario, your automobile liability insurance coverage would pay out to fix the other driver’s vehicle and cover any injuries they may have suffered as a result of the collision.

While most insurers specify a specific limit for each portion of your auto liability coverage, another product called a “Combined Single Limit” liability policy limits coverage for all components of a liability insurance claim to a single amount. This policy essentially pools the bodily injury and property damage amounts into one single coverage limit.

Example) Assume an at-fault driver has an auto liability policy that covers $100k per person/$300k per accident for bodily injury and $50k for property damage. If he totals another party’s $80,000 vehicle, his insurance will pay out up to the $50,000 property damage limit, but the excess will be his responsibility. Assume that the same driver has a $350,000 Combined Single Limit policy. In that scenario, the entire $80,000 would be covered by the policy.

Important Note: Insurance laws vary by state. Check with your local insurance professional regarding your area’s specific rules and regulations.

M

Managed Fuel Card Program

Managed fuel card programs are designed to simplify the process of obtaining fuel for drivers, compile relevant data for managers, and lower overall fuel spending for the company.

The specifics of each program will vary depending on the company offering it.

Motorlease’s Managed Fuel Card Plus Program allows you to control all of your fuel expenses in one convenient and flexible program, with the client deciding which exceptions they want to be reported.

Accepted at over 95% of U.S. fuel stations and thousands in Canada, there will be no need for your drivers to plan routes around where to fuel or go out of their way to find the right gas station. Downloading the WEX Connect app in conjunction with the Motorlease Fuel Card Plus program will also allow your drivers to find the cheapest nearby fuel, thus saving your company money. The result is a fuel card program that empowers both you and your drivers.

Key Benefits

- Motorlease creates drivers and orders branded fuel cards for new hires

- Motorlease will order replacement fuel cards for circumstances where a card is lost or damaged

- Motorlease monitors account activity and will notify the driver and fleet administrator if an alert has been triggered for items such as no mileage entry made at the pump, High-dollar fuel purchases, & Excessive fill-ups

- Motorlease provides detailed monthly reporting telling you who bought what, when, where, and for how much

- Motorlease will cancel cards and ‘terminate’ drivers for those who are no longer employed by the customer or those who no longer qualify for a fuel card

- Motorlease provides reporting of fuel card data, such as Miles per gallon, Cost per mile, Dollar spent per driver

Streamlined Billing

In addition to all the benefits above, the Managed Fuel Card Plus Program includes streamlined pass-through billing. WEX will invoice Motorlease directly for your entire monthly fuel spend, and you’re billed back via one simple, easy-to-read invoice from Motorlease.

Motor Vehicle Report (MVR)

Put simply, a Motor Vehicle Report, or MVR for short, is a report card for your driving history.

The amount of information disclosed on an MVR varies by state. Some states keep records for as few as 3 years, while others go back for as long as 10 years.

Typically, an MVR will show license information, information on driving violations and crimes, and other driver-related information.

Some things to expect to see on an MVR are:

- License Number

- Expiration Date

- Full Name

- Date of Birth

- License Restrictions

- Height/Weight/Gender

- Hair/Eye Color

- Issue Date

- License Type

- Accident Reports

- Traffic Violations

- License Suspensions

- Vehicular Crimes

- License Points (if applicable in your state)

MVRs are usually kept only by the state in which you are licensed. There is no national MVR database.

Depending on your state, certain items on your MVR may be expunged after a specified amount of time.

Example) Your state may remove speeding violations after a period of 3 years however a DUI may remain on your record for 10 years.

Why Are MVRs Important?

If you are an employer with people on the road, it is imperative to ensure that your employees are safe and trustworthy drivers. This is not only important for their safety and the safety of others, but it is an important step in mitigating potential liability risks. Companies who don’t appropriately vet their drivers are potentially leaving themselves open to negligent entrustment claims.

Most companies will run an MVR check on any potential driver prior to hire. While that’s a good start, it’s often not enough, as a lot can happen after hiring an employee. Many companies are now making it a habit to run annual MVR checks on all of their employees who operate vehicles in the course of business. In some cases, companies are even utilizing a service that allows continuous monitoring of new violations.

Doing so could help illustrate to a court that the company has done and continued to do their due diligence when putting people on the road.

P

Personal Use

One of the most overlooked aspects of a company-vehicle program is that of Personal Use.

When driving a company-provided vehicle, all the miles that are driven can be classified in one of two ways: Business Miles or Personal Miles. What’s the difference between the two? Business miles are any miles driven between two business locations (except for commuting to/from your office). Personal miles are any miles driven outside of the course of doing business.

Example) Driving from your office to a client meeting would be considered business mileage. Conversely, driving home from that meeting or driving to a doctor’s appointment during your lunch break would be considered personal mileage.

Why is it Important to Differentiate Between Personal and Business Miles?

The reason why it is necessary to differentiate between the two types of miles is because, per the IRS, a company-provided vehicle is considered to be a fringe benefit, and thus there is a small cost to the employee.

*Pro Tip*: We discuss the formula for calculating what an employee would owe for the personal use of their company vehicle in our article entitled ‘How is the Fair Market Value of Personal Use Calculated?’, and the various methods of collection in our article entitled ‘Personal Use Charges: Methods of Collection.’

Because the amount of money an employee may owe is based upon the amount of personal miles that are driven, it’s vital that accurate mileage logs are kept. If an employee fails to keep records of their mileage, the IRS may deem that 100% of the miles driven were for personal use. There are various methods of tracking mileage, either electronically or by hand, but whatever method is chosen should capture a few key pieces of data. Things such as the date, beginning location, ending location, starting odometer, ending odometer, total mileage, nature of the trip, and any ancillary costs (such as tolls) should all be noted.

To eliminate any potential confusion, employers need to be sure to have a clearly defined policy when it comes to personal use. Outlined within should be rules and regulations regarding acceptable use of the vehicle, as well as procedures for accurate reporting of mileages. Doing so will eliminate potentially costly mistakes and make both employee’s and employer’s lives easier.

Personal Use Tracking

When driving a company-provided vehicle, all the miles that are driven can be classified in one of two ways: Business Miles or Personal Miles. What’s the difference between the two? Simply put, business miles are any miles driven between two business locations (except for commuting to/from your office). Personal miles are any miles driven outside of the course of doing business. For example, driving from your office to a client meeting would be considered business mileage. Conversely, driving home from that meeting, or driving to a doctor’s appointment during your lunch break would be considered personal mileage.

Why is it necessary to differentiate between the two types of mileages? Because, per the IRS, a company-provided vehicle is considered a fringe benefit, and thus, there is a small cost to the employee. That is the amount the employee must pay to cover the personal use portion of their company-provided vehicle, which will be reflected on their W-2 form.

Because the amount of money that an employee may owe is based upon the number of personal miles that are driven, it’s vital that accurate mileage logs are kept. Should an employee fail to keep records of their mileage, the IRS may deem that 100% of the miles driven were for personal use. There are various methods of tracking mileage, either electronically or by hand, but whatever method is chosen should capture a few key pieces of data. Things such as the date, beginning location, ending location, starting odometer, ending odometer, total mileage, nature of the trip, and any ancillary costs (such as tolls) should all be noted.

Motorlease offers a simple, easy-to-use online portal for drivers to accurately log their personal and business mileage to help keep your company compliant with IRS rules and regulations.

R

Residual Value

The expected value of the vehicle being leased at the end of the contracted lease term (months & miles).

T

Telematics

Telematics, a term derived from combining “telecommunications” and “informatics”, is used to describe the capture and display of meta-data that is not always readily available to the vehicle’s driver.

Telematics systems can capture information such as speed, idle time, braking pressure, location, vehicle diagnostics, collision information, traffic information, weather, etc. They can also be set up to trigger alerts to the administrator whenever a specific situation occurs.

Example) A telematics system may be set up to send an alert to the fleet administrator whenever a vehicle’s speed is over 65 mph.

Essentially, a telematics system is akin to a black box recorder found on airplanes.

How Telematics Systems Work

While some telematics systems, such as OnStar, are built directly into the vehicle, telematics for commercial applications usually involve installing a 3rd party device into the vehicle (commonly the OBDII Port). That device records data from your vehicle and transmits it wirelessly via a cellular network to a secure server. The data is then transcribed and displayed in an easy-to-understand format on a website or app to be used at the fleet manager’s discretion.

Benefits of Telematics

For many fleets, the benefits of telematics systems are numerous. They include:

Fuel Savings: Telematics systems can help identify excess idle time and and routes, thus reducing unnecessary fuel waste.

Driver Location and Routing: Many companies find that knowing where their drivers are located or designing the most efficient route for them to complete their job is vital for their employer and their customers.

Improved Safety and Possibly Reduced Liability – Telematics systems can provide continuous feedback on driving habits, logging data such as speed and hard braking. This will provide companies with opportunities to reinforce safe driving habits with their employees. Additionally, companies have used telematics to exonerate their drivers from being wrongfully accused.

Toll Management

Managing your fleet’s toll program can be a major headache. Establishing numerous toll accounts, reconciling invoices from different drivers in different areas, and paying toll violations all take time out of your day and money out of your company’s pockets. Motorlease’s Toll Management Program eliminates all of those hassles.

Our all-in-one, easy-to-use program is designed to save both you and your drivers time and money.

Program benefits include:

- No transponder necessary*

- Nearly nationwide coverage

- No service charges for toll violations

- No waiting in long lines at toll booths

- Works for any vehicle, whether it’s provided by Motorlease, owned by your organization, or leased from another vendor

- Consolidated billing eliminates the need for individual expense reports from drivers

*Gated toll booths do not have plate readers and thus will require the toll amount to be paid to the attendant.

Tolls

Fees are charged for using toll roads, bridges, or tunnels.

U

Uplift

Modifications or additions made to a vehicle to meet specific business needs, such as installing specialized equipment, shelving, or branding.

V

Vehicle Life Cycle

A vehicle’s life cycle begins when it is manufactured and ends when it’s no longer operable. Between those two points in time, multiple owners and hundreds of thousands of miles may be driven. In the fleet world, life cycling refers to how long you keep a vehicle before replacing it with a new one.

Why is Establishing a Vehicle Life Cycle Important?

Establishing a vehicle life cycle is important for a number of reasons.

Firstly, by establishing a vehicle life cycle, you can more accurately budget expenses for years in advance. A defined life cycle limits the variables in your fleet operation and allows for more accurate calculations.

Additionally, establishing a life cycle will assist in maintaining a good corporate image. Fair or not, we tend to make judgements based on first appearances. Letting your vehicles become old and worn-looking could negatively impact how customers view you.

Finally, if safety is important to you, then establishing a vehicle life cycle should be as well. Manufacturers are innovating at a torrid pace, and it seems that every model year some new safety advancements are being made. Establishing a vehicle life cycle will ensure that your drivers are consistently placed in vehicles with the latest safety technologies, keeping them and others safe.

Depreciation vs Useful Life

It’s important to distinguish between depreciation and useful life, especially for those operating equity leases. During the course of an equity lease, you’re depreciating the vehicle down by a set percentage every month. After a specified number of months, the vehicle is 100% depreciated. However, this does not necessarily mean that the vehicle has no useful life left and you need to replace it immediately. A vehicle’s life can stretch far beyond the point in which the book value is 100% depreciated, depending on how it’s utilized. Most fleet management companies will assist you in evaluating this potentially tricky area.

W

WEX Fuel Card

A WEX fuel card is a card provided by the company WEX that drivers use as a credit card for fuel purchases.

While most cards are restricted to fuel purchases only, some cards allow for all vehicle-related maintenance to be charged on them. It is important to know which type of card you have to prevent confusion and possible declined charges.

From the driver’s perspective, a fuel card simplifies the process of obtaining fuel. Drivers simply swipe their card, submit their odometer reading, and enter their personal PIN.

Since WEX fuel cards are accepted at over 95% of U.S. fuel stations, and thousands in Canada, there is no need for drivers to plan routes around where to fuel or go our of their way to find the right gas station. WEX fuel card holders can also download the WEX Connect app in conjunction with their fuel card. This app will allow them to find the cheapest nearby fuel, thus saving their company money.

From the company’s perspective, WEX fuel cards provide them with controls and valuable data to allow them to manage their fuel spend more efficiently, if not managed by an outside party like a fleet management company.

WEX Fuel cards also allow for specific alerts to be established. If one of the pre-set issues occurs, such as no mileage entry made at the pump, a high-dollar fuel purchase, or excessive fill-ups, a notification will be sent to both the driver as well as the fleet administrator.

Fleet administrators are also provided with detailed reports illustrating who bought what, when, where, and for how much. Additional data is also available for analysis, including reports on miles per gallon, Cost per mile, dollar spent per driver, and more. The result is more insight and control over the program.

Expertise in Every Mile

Lower Costs

Reduce expenses without compromising quality. We secure competitive pricing and optimize your fleet’s performance to save your business money.

Save Time