Amortization refers to the process of spreading out a loan into a series of payments.

These payments consist of two portions: principal and interest. While the amount of each payment generally stays the same, the portion of your payment that goes toward each respective portion changes over time.

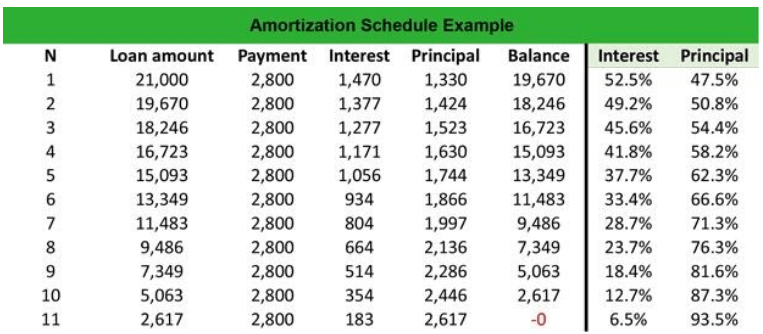

Example) A mortgage is amortized over a set period. At the beginning of your term, the vast majority of your payment goes toward interest on the loan. As the loan matures, the portion that is allocated for interest decreases while a greater portion of your payment goes towards paying down the principal. The last payment of the loan will pay off the entire debt.

An amortization schedule, sometimes referred to as an “amortization table”, is an illustration of exactly how your loan works and can help you see exactly what your outstanding balance or interest cost is at any point during the term.

What Information Will I See in an Amortization Schedule?

Amortization schedules show several pieces of information such as:

Scheduled Payments – The table will list all of your required payments by due date for the length of the loan.

Interest Expenses – A portion of each payment is allocated towards interest. Your amortization schedule will show you exactly how much of each payment is going towards finance charges.

Principal Repayment – After the interest portion is accounted for, the remainder of your payment will be applied towards principal. Like interest expenses, the amortization schedule will illustrate exactly how much of each payment is allocated towards paying down the original loan amount.

Example) Below is a sample amortization schedule

Why is an Amortization Schedule Useful

Amortization schedules help those financing make informed decisions regarding their loans and financial obligations. With an amortization schedule, the borrow can calculate exactly how much they’re paying in finance charges as well as where they stand in regard to their principal at any given time.

Example) A company is considering terminating their equity lease after 24 months. Having an amortization schedule allows them to compare their remaining principal against the potential book value. Having this information will allow them to determine whether terminating the lease at that point in time is a wise decision.